How to Make Bulk Payments with TransferGo: A Guide for Businesses

How to Make Bulk Payments with TransferGo: A Guide for Businesses

Introduction

Are you tired of manually processing individual payments for your business? Do you want to save time and streamline your payment process? Look no further than TransferGo’s bulk payment feature! In this guide, we will walk you through the steps to make bulk payments with TransferGo, helping you manage your business’s financial transactions efficiently.

What are bulk payments?

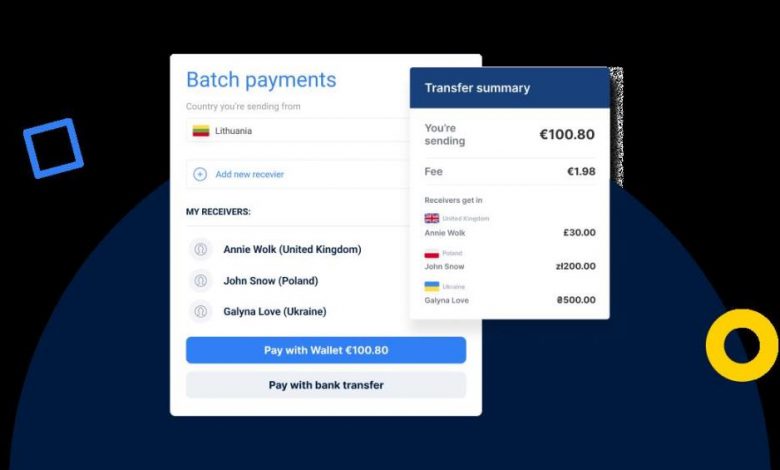

Bulk payments refer to the process of sending multiple payments simultaneously to different recipients. It is an efficient way for businesses to handle regular payments, such as salaries, vendor payments, and invoices, in a single transaction. With TransferGo’s bulk payment feature, you can easily execute multiple transactions at once, saving you time and effort.

Steps to Make Bulk Payments with TransferGo

Step 1: Sign up for a TransferGo business account

If you haven’t already, visit the TransferGo website and sign up for a business account. Provide the necessary information and complete the verification process. Once your account is approved, you can start using the bulk payment feature.

Step 2: Import beneficiary details

To make bulk payments, you need to import the beneficiary details. TransferGo provides an easy-to-use CSV template where you can enter the recipient’s name, email, bank account details, and payment amount. You can download this template from your TransferGo business account dashboard.

Step 3: Upload the beneficiary CSV file

Once you have filled in the beneficiary details in the CSV template, save the file and upload it to your TransferGo business account. The system will verify the data and display an overview of the transactions.

Step 4: Review and confirm transactions

Take a moment to review the transactions displayed on the overview page. Ensure that all the information, including payment amount and beneficiary details, is accurate. Once you are satisfied, confirm the transactions to proceed.

Step 5: Complete the payment

After confirming the transactions, TransferGo will generate a summary of the bulk payment. Review this summary, ensuring that all the details are correct. Finally, authorize the payment to complete the process. TransferGo will securely transfer the funds to the recipients’ bank accounts.

Frequently Asked Questions (FAQs)

Q1: What currencies are supported for bulk payments with TransferGo?

TransferGo supports a wide range of currencies for bulk payments. Some popular options include EUR, GBP, USD, AUD, CAD, and many more. For a complete list of supported currencies, refer to the TransferGo website.

Q2: Can I schedule bulk payments in advance?

Yes, TransferGo allows you to schedule bulk payments in advance. When confirming the transactions, you can specify the desired date for payment execution. This feature is particularly useful for businesses managing their cash flow and planning ahead.

Q3: Is there a limit on the number of transactions I can make in a bulk payment?

TransferGo does not impose a limit on the number of transactions you can make in a bulk payment. However, keep in mind that individual limits for transfers may apply. Refer to TransferGo’s terms and conditions or contact their customer support for more information.

Q4: How secure is TransferGo’s bulk payment feature?

TransferGo ensures the highest level of security when it comes to bulk payments. All transactions are encrypted using the latest technology, and the platform is designed to comply with the strictest security standards. Your business and beneficiary data will remain confidential throughout the process.

Conclusion

Managing bulk payments for your business doesn’t have to be complicated. By using TransferGo’s bulk payment feature, you can save time, streamline your payment process, and focus on growing your business. Sign up for a TransferGo business account today and enjoy the convenience of making bulk payments effortlessly.